In brief

What’s new

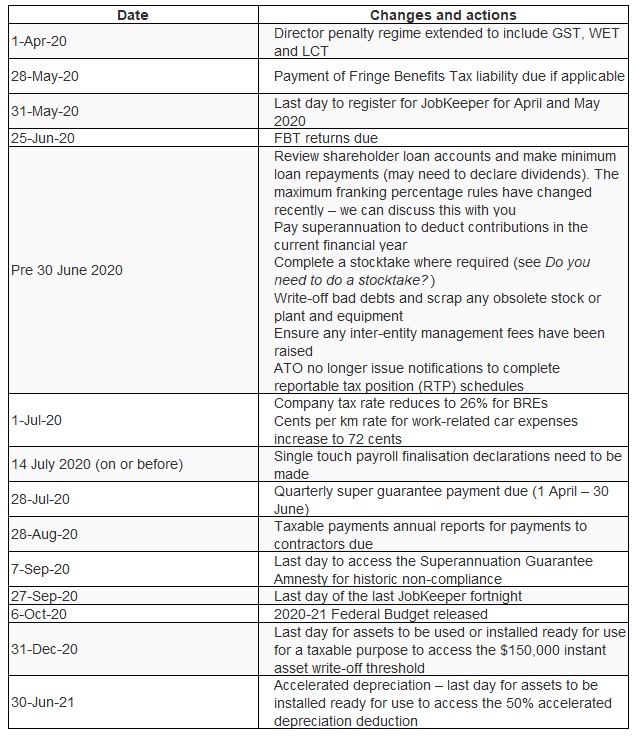

2020-21 Federal Budget delayed until October

The release of the 2020-21 Federal Budget has been postponed from its traditional date in May until 6 October 2020. We expect there will be a number of reforms and measures to tighten spending, recover revenue, and range of productivity measures. We will keep you advised of significant changes that might impact on you and your company.

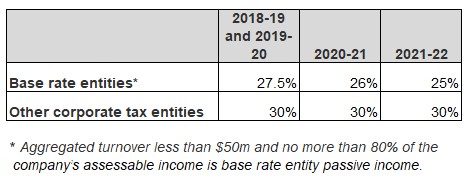

Company tax rate reduction

From 1 July 2020, the company tax rate for base rate entities will reduce to 26%.

Utilising franking credits

The reduction in the company tax rate will also change the maximum franking rate that applies to dividends paid by base rate entities (BRE). The way the rules normally work is that if the company was classified as a base rate entity and was taxed at the lower corporate tax rate in the previous year then a lower maximum franking rate will apply to dividends paid in the current year. For example, the maximum franking rate for a BRE that pays a franked dividend in the 2020 year is 27.5%. However, in 2021, the maximum franking rate will be 26%.

Some companies may have franking account balances that have accumulated over time and will reflect prior company tax rates. It is important to consider how these credits can be utilised in an efficient manner. One strategy could be to bring forward the payment of dividends to utilise the current 27.5% franking rate before the company tax rate reduces to 26% if the cashflow of the company allows for it.

Living with JobKeeper

The JobKeeper $1,500 per fortnight per employee subsidy is paid in arrears to businesses that have experienced a downturn of 30% or more (50% for businesses with turnover of $1bn or more). A 15% threshold is used for ACNC-registered charities. The purpose of the scheme is to keep workers employed and ensure there is a viable workforce on the other side of the pandemic.

At present, JobKeeper is set to continue until 27 September 2020. And for businesses, JobKeeper’s decline in turnover is a once only test. If the eligibility criteria were met at the time of applying for JobKeeper, a business can continue claiming the subsidy assuming the other eligibility criteria for them and the individual employees, are met.

However, we expect continuing eligibility to the subsidy will change over time as the regulators gain a clearer insight into the impact of the pandemic. Much of this data is likely to come from the actual and estimated GST turnover that forms part of the compulsory monthly JobKeeper reporting requirements in tandem with the volume of applications to Jobseeker. That is, are the right businesses receiving JobKeeper and is the subsidy keeping workers employed?

If your business did not initially qualify for JobKeeper, you can apply to start JobKeeper payments when you meet the eligibility criteria. Not every industry will experience the economic impact of the pandemic in the same way. Some will experience a greater decline in later months.

One of our most asked questions about the decline in turnover test is ‘what if I got it wrong?’ Eligibility is generally based on an estimate of the negative impact of the pandemic on an individual business’s turnover. Some will experience a greater decline than estimated while others will fall short of the required 30%, 50% or 15%. There is no clawback if you got it wrong as long as you can prove the basis for your eligibility going into the scheme. For those that, in hindsight, did not meet the decline in turnover test, you need to ensure you have your paperwork ready to prove your position if the ATO requests it. You will need to show how you calculated the decline in turnover test and how you came to your assessment of your expected decline, for example, a trend of cancelled orders or trade conditions at that time.

Making JobKeeper payments on time

To be eligible for JobKeeper payments, staff must be paid at least $1,500 during each JobKeeper fortnight. If you pay employees less frequently than fortnightly, the payment can be allocated between fortnights in a reasonable manner. For example, if you pay your employees on a monthly pay cycle, your employees must have received the monthly equivalent of $1,500 per fortnight.

For the first two JobKeeper fortnights (30 March-12 April, 13 April-26 April), employers had an extension until 8 May to make the JobKeeper payments to eligible employees. For the remaining JobKeeper fortnights, employees will need to receive at least $1,500 by the end of each JobKeeper fortnight or the monthly equivalent of $1,500 per fortnight. Depending on your pay cycle, this may require some adjustments each month.

Tax treatment of Government grants and relief

During the pandemic, bushfires and floods, grants and loans have been available to help business and individuals through the crisis. The way these grants and loans are taxed will vary.

If you carry on a business and the payment relates to your continuing business activities, then it is likely to be included in your assessable income for income tax purposes. This position is likely to be different where the payment was made to enable you to commence a new business or cease carrying on a business.

Grants will generally be assessable income unless a law has been passed to specifically exclude the grant or loan from tax. For example, the special disaster grant for the bushfires was made non‑assessable and non-exempt income. Also, amounts provided under the cash flow boost measure are non-assessable non-exempt income.

When it comes to GST treatment, the key issue is whether the grant is consideration for a supply. That is, was the business expected to deliver something for the grant? The following government payments are not consideration for a supply and therefore not subject to GST or included in your GST turnover:

- JobKeeper payment

- Cash flow boost payment

- The Early Childhood Education & Care Relief Package paid to approved child care providers

- Payment of grants to an entity where the entity has no binding obligations to do anything or does not provide goods and services in return for the monies.

Superannuation guarantee amnesty

7 September 2020 is the last day for employers to take advantage of the superannuation guarantee (SG) amnesty. The amnesty provides a one-off opportunity to disclose historical non-compliance with the superannuation guarantee rules and pay outstanding superannuation guarantee charge amounts.

To qualify for the amnesty, employers must disclose the outstanding SG to the Tax Commissioner. You either pay the full amount owing, or if the business cannot pay the full amount, enter into a payment plan with the ATO. If you agree to a payment plan and do not meet the payments, the amnesty will no longer apply.

Keep in mind that the amnesty only applies to “voluntary” disclosures. The ATO will continue its compliance activities during the amnesty period so if they discover the underpayment first, full penalties apply. The amnesty also does not apply to amounts that have already been identified as owing or where the employer is subject to an ATO audit

Even if you do not believe that your business has an SG underpayment issue, it is worth undertaking a payroll audit to ensure that your payroll calculations are correct, and employees are being paid at a rate that is consistent with their entitlements under workplace laws and awards.

If your business has engaged any contractors during the period covered by the amnesty, then the arrangements will need to be reviewed as it is common for workers to be classified as employees under the SG provisions even if the parties have agreed that the worker should be treated as a contractor. You cannot contract out of SG obligations.

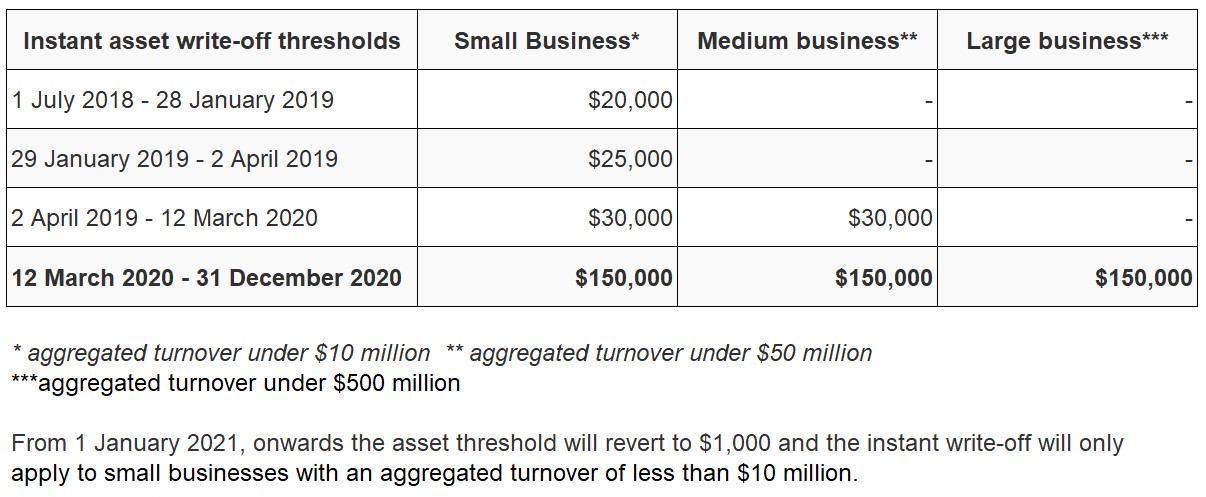

Utilising the $150,000 instant asset write-off

The instant asset write-off enables your business to claim an upfront deduction for the full cost of depreciating assets in the year the asset was first used or installed ready for use for a taxable purpose.

The COVID-19 stimulus measures temporarily increased the threshold for the instant asset write-off between 12 March 2020 and 31 December 2020 from $30,000 to $150,000, and expanded the range of businesses that can access the threshold to those with an aggregated turnover of less than $500 million.

For example, if your company’s turnover is under $500 million and you purchase an eligible asset for $140,000 (GST-exclusive) on 1 June 2020 (and install it ready for use by 30 June 2020), then a deduction of $140,000 can be claimed in 2019-20. If the company is subject to a tax rate of 27.5% then this should reduce the tax payable by the company for the 2020 income year by $38,500.

If your business is likely to make a tax loss for the year, then the instant asset write-off is unlikely to provide a direct short-term benefit to you. However, if this measure is likely to reduce the taxable income of the business for the year then it may be possible to vary upcoming PAYG instalments to improve cash flow.

If the asset is a luxury car then the deduction will be limited to the luxury car limit ($57,581 in 2019-20).

The business use percentage of the asset also needs to be taken into account in calculating the deduction.

The increase to the instant asset write-off threshold in the stimulus package is the fourth increase or extension and businesses will need to be wary of what they are claiming and when:

Accelerated depreciation deductions

Businesses with a turnover of less than $500 million can access accelerated depreciation deductions for assets that don’t qualify for an immediate deduction for a limited period of time.

This incentive is only available in relation to:

- New depreciable assets

- Acquired on or after 12 March 2020 that are first used or installed ready for use for a taxable purpose by 30 June 2021.

It does not apply to second-hand assets or buildings and other capital works expenditure. The rules also won’t apply if the business entered into a contract to acquire the asset before 12 March 2020.

Businesses are able to deduct 50% of the cost of a new asset in the first year. They can then also claim a further deduction in that year by applying the normal depreciation rules to the balance of the cost of the asset.

Accelerated depreciation deductions apply from 12 March 2020 until 30 June 2021. This will bring forward deductions that would otherwise be claimed in later years.

For example, let’s assume that a business purchases a new truck for $250,000 (exclusive of GST) in July 2020. In the 2020-21 tax return the business would claim an upfront deduction of $125,000. The business would also claim a further deduction for the depreciation on the balance of the cost. Let’s assume that a 26.7% depreciation rate applies to this asset, which would mean an additional deduction of $33,375. The total deduction in the 2020-21 tax return would be $158,375. Without the introduction of accelerated depreciation the business would have claimed a deduction of $66,750.

Directors at risk of personal liability for company’s GST liabilities

The director penalty regime enables the ATO to recover amounts owed by a company for unpaid PAYG withholding amounts and superannuation guarantee liabilities from the directors or former directors.

From 1 April 2020, the existing director penalty regime was expanded to include GST, luxury car tax and wine equalisation tax liabilities. The expansion of this regime means that company directors, regardless of whether they are passively or actively involved, are at risk of being held personally liable for a large portion of a company’s estimated liabilities.

Directors are under a general obligation to ensure the company either satisfies its tax liabilities, or recognising the company may be insolvent, goes into administration or is wound up. Resigning as a director after the event has no impact as the obligation attaches to the individual directors equally. If the Commissioner issues a penalty notice, the director becomes personally liable at that point. There is a grace period for new directors, but they can become liable for obligations that arose before they became a director.

Strict timeframes are in place for the issuing of notices by the Commissioner and the required responses from the individual. If you receive a director penalty notice, or if you are concerned that you are at risk of receiving a notice, please contact us immediately.

Reportable tax position expansion

Reportable tax position (RTP) schedules accompany the company tax return and require large businesses to disclose their contestable and material tax positions. These include tax uncertainty in the income tax return and/or financial statements, and specific risks or issues based on available guidance.

For the years ending on or after 30 June 2019, the ATO will no longer issue notifications to taxpayers to complete the RTP schedule and instead companies will need to self-assess. RTP schedules are required where the entity is a public company or a foreign owned company and it has total business income of either:

- $250 million or more in the current year; or

- $25 million or more in the current year and the entity is part of a public or foreign owned economic group with total business income of $250 million or more in the current or immediately prior year. An economic group includes all entities (including companies, trusts, partnerships and other entities) that lodge an Australian tax return under a direct or indirect Australian or foreign ultimate holding company or other majority controlling interest.

Reporting payments to contractors

The taxable payments reporting system requires businesses in certain industries to report payments they make to contractors (individual and total for the year) to the ATO. ‘Payment’ means any form of consideration including non-cash benefits and constructive payments. Almost every year a new industry or sector is drawn into the taxable payments reporting net.

Taxable payments reporting is required for:

- Building and construction services

- Cleaning services

- Courier services

- Road freight services

- Information technology (IT) services

- Security, investigation or surveillance services

- Mixed services (providing one or more of the services listed above)

The annual report is due by 28 August 2020. This will be the first report for those businesses providing road freight, information technology, and security, investigation or surveillance services.

Company tax residency developments

In late 2018, the ATO changed its guidance on the tax residency rules for companies incorporated overseas.

In broad terms, a company can be treated as a resident of Australia for tax purposes if either:

- It is incorporated in Australia, or

- It carries on business in Australia and either its central management and control is in Australia or its voting power is controlled by Australian residents.

In general, the ATO’s new approach means that a company can be treated as a resident of Australia if:

- It carries on any business activities, anywhere; and

- Central management and control of the company is in Australia.

The new approach means that companies previously classified as non-residents might be treated as residents of Australia. If a company is classified as a tax resident of Australia then it would generally be taxed in Australia on its worldwide income, but this is subject to the foreign branch profits exemption. For example, if a company carries on a business (any business, which could include deriving passive income from investments) and has its central management and control in Australia, then it would generally be treated as a resident.

The ATO initially provided a transitional period for companies to assess their position and consider making necessary changes. While this transitional period was to end at 30 June 2019, the ATO has now extended this deadline to:

- 31 December 2020 - Early balancer taxpayer with a 31 December year-end

- 30 June 2021 - Taxpayer with a 30 June year-end

The deadline extension applies to companies that are, “taking active and timely steps to change their governance arrangements.”

1 January 2020 changes to Super Guarantee calculation

From 1 January 2020, new rules came into effect to ensure that an employee’s salary sacrifice contributions cannot be used to reduce the amount of superannuation guarantee (SG) paid by the employer.

Previously, some employers were paying SG on the salary less any salary sacrificed contributions of the employee. Now, employers must contribute 9.5% of an employee’s Ordinary Time Earnings (OTE) and they choose whether or not to include the salary sacrificed amounts in OTE.

Under the new rules, the SG contribution is 9.5% of the employee’s ‘ordinary time earnings (OTE) base’. The OTE base will be an employee’s OTE plus any amounts sacrificed into superannuation that would have been OTE, but for the salary sacrifice arrangement.

The amendments also ensure that where an employer has not fulfilled their SG obligations and the superannuation guarantee charge is imposed, the shortfall is calculated using the new OTE base.

Cents per kms change for work-related car expenses

The rate at which work-related car expenses can be claimed using the cents per kilometre method will increase from 1 July 2020 from 68 cents to 72 cents per kilometre.

Using this method a maximum of 5,000 business kilometres can be claimed per year per car.

Impending changes

Division 7A reforms

Division 7A captures situations where shareholders access company profits in the form of loans, payments or forgiven debts. If certain steps are not taken, such as placing the ‘payment’ under a complying loan agreement, these amounts are treated as a deemed unfranked dividend and taxable at the taxpayer’s marginal tax rate.

Sweeping reforms to the operation of Division 7A were to take effect from 1 July 2020. However, these reforms have not been enacted. Given the extent of the proposed changes and the uncertainty created by COVID-19, we expect the timing of these reforms to be revised in the October federal budget.

R&D tax incentive overhaul

The impending overhaul of the R&D tax incentive system is not yet law. Originally intended to take effect from 1 July 2018, the sweeping reforms are now set to take effect from 1 July 2019, assuming the legislation passes Parliament.

Under these reforms, the way the R&D tax incentive applies will change to focus on ‘more intensive’ R&D activities, particularly in medical and clinical development. The changes attempt to refocus the incentive on activities that go well beyond what companies would normally do to improve.

Companies under $20m

For companies with an aggregated annual turnover less than $20 million:

- An annual $4 million cap will be introduced on cash refunds for R&D claimants. Amounts that are in excess of the cap will become a non-refundable tax offset and can be carried forward into future income years;

- Clinical trials will be excluded from the $4 million cap on cash refunds, to encourage development in this area; and

- The refundable R&D tax offset will be amended and will become a premium of 13.5 percentage points above the company’s tax rate for that year.

Companies over $20m

For companies with aggregated annual turnover of $20 million or more, an R&D premium will be introduced that ties the rates of the non-refundable R&D tax offset to the incremental intensity of R&D expenditure as a proportion of total expenditure for the year.

The R&D expenditure threshold - the maximum amount of R&D expenditure eligible for concessional R&D tax offsets - will be increased from $100 million to $150 million per annum.

In addition, where an R&D entity benefits from a government recoupment (such as a grant or reimbursement) for expenditure that is also eligible for the R&D tax offset, a clawback applies to reverse the double benefit that arises. The clawback is in the form of an additional 10% tax on the recoupment.

The ATO has stated that once the legislation has passed, taxpayers will need to review their position for the 2019-20 year to ensure compliance with the new laws. We will keep you up to date of the progress of these reforms.

Financial housekeeping

Lodgement deferrals

If the company is likely to have trouble meeting its lodgement deadlines, please contact as soon as possible and we will request a deferral on your behalf

If the company is likely to have trouble paying its tax liability, please let us know as soon as possible and we will negotiate a deferral or payment plan with the ATO on your behalf.

Before you roll-over your software…

Before rolling over your accounting software for the new financial year, make sure you:

- Prepare your financial year-end accounts. This way, any problems can be rectified and you have a ‘clean slate’ for the 2020-21 year. Once rolled over, the software cannot be amended.

- Do not perform a Payroll Year End function until you are sure that your STP finalisation declaration is correct and printed. Always perform a payroll back-up before you roll over the year.

Employee reporting

Single touch payroll

Where payments to employees have been reported to the ATO through single touch payroll, a finalisation declaration generally needs to be made by 14 July 2020 for employers with 20 or more employees and 31 July for those with 19 or fewer employees.

Payment summaries do not have to be provided to employees. Instead, employees will be able to access their Income Statement through myGov.

Reportable Fringe Benefits

Where you have provided fringe benefits to your employees in excess of $2,000, you need to report the FBT grossed-up amount. This is referred to as a `Reportable Fringe Benefit Amount’ (RFBA).

Selecting the best stocktake value method

Businesses that buy and sell stock generally need to do a stocktake at the end of each financial year as the increase or decrease in the value of stock is included when calculating the taxable income of your business. If you do need to complete a stocktake, you can choose one of three methods to value trading stock:

- Cost price – all costs connected with the stock including freight, customs duty, and if manufacturing, labour and materials, plus a portion of fixed and variable factory overheads, etc.

- Market selling value - the current value of the stock you sell in the normal course of business (but not at a reduced value when you are forced to sell it).

- Replacement value - the price of a substantially similar replacement item in a normal market on the last day of the income year.

A different basis can be chosen for each class of stock or for individual items within a particular class of stock. This provides an opportunity to minimise the trading stock adjustment at year-end. There is no need to use the same method every year; you can choose the most tax effective option each year. The most obvious example is where the stock can be valued below its purchase price because of market conditions or damage that has occurred to the stock. This should give rise to a deduction even though the loss has not yet been incurred.

Reduce your risks & minimise your tax

Top tax tips

1. Declare dividends to pay any outstanding shareholder loan accounts

If your company has advanced funds to a shareholder or related party, paid expenses or allowed a shareholder or other related party to use assets owned by the company, then this can be treated as a taxable dividend. The regulators expect that top up tax (if any applies) should be paid by shareholders at their marginal tax rate once they have access to these profits. This is unless a complying loan agreement is in place.

If you have any shareholder loan accounts from prior years that were placed under complying loan agreements, the minimum loan repayments need to be made by 30 June 2020. It may be necessary for the company to declare dividends before 30 June 2020 to make these loan repayments.

The tax rules in this area can be extraordinarily complex and can lead to some very harsh tax outcomes. It is important to talk to us as soon as possible if you think your company has made payments or advanced funds to shareholders or related parties.

2. Directors’ fees and employee bonuses

Any expected directors’ fees and employee bonuses may be deductible for the 2019-20 financial year if you have ‘definitely committed’ to the payment of a quantified amount by 30 June 2020, even if the fee or bonus is paid to the employee or director after 30 June 2020.

You would generally be definitely committed to the payment by year-end if the directors pass a properly authorised resolution to make the payment by year-end. The employer should also notify the employee of their entitlement to the payment or bonus before year-end.

The accrued directors’ fees and bonuses need to be paid within a reasonable time period after year-end.

3. Write-off bad debts

To be a bad debt, you need to have brought the income to account as assessable income and given up all attempts to recover the debt. It needs to be written off your debtors’ ledger by 30 June. If you don’t maintain a debtors’ ledger, a director’s minute confirming the write-off is a good idea.

4. Review your asset register and scrap any obsolete plant

Check to see if obsolete plant and equipment is sitting on your depreciation schedule. Rather than depreciating a small amount each year, if the plant has become obsolete, scrap it and write it off before 30 June.

If your business was previously classified as a small business and assets were allocated to a small business pool, you can continue to claim one deduction for each pool for these assets.

5. Bring forward repairs, consumables, trade gifts or donations

To claim a deduction for the 2019-20 financial year, consider paying for any required repairs, replenishing consumable supplies, trade gifts or donations before 30 June.

6. Pay June quarter employee super contributions now

Pay June quarter super contributions this financial year if you want to claim a tax deduction in the current year. The next quarterly superannuation guarantee payment is due on 28 July 2020. However, some employers choose to make the payment early to bring forward the tax deduction instead of waiting another 12 months.

Don’t forget yourself. Superannuation can be a great way to get tax relief and still build your personal wealth. Your personal or company sponsored contributions need to be received by the fund before 30 June to be deductible.

7. Realise any capital losses and reduce gains

Neutralise the tax effect of any capital gains you have made during the year by realising any capital losses – that is, sell the asset and lock in the capital loss. These need to be genuine transactions to be effective for tax purposes.

8. Raise management fees between entities by June 30

Where management fees are charged between related entities, make sure that the charges have been raised by 30 June. Where management charges are made, make sure they are commercially reasonable and documentation is in place to support the transactions. If any transactions are undertaken with international related parties then the transfer pricing rules need to be considered and the ATO’s documentation expectations will be much greater. This is an area under increased scrutiny.